Inquiry

Wave of Decline Sweeps Lithium-Ion Battery Pack Pricing, in 2024 Displays a Notable 20% Dip Amidst Intensifying Market Competition

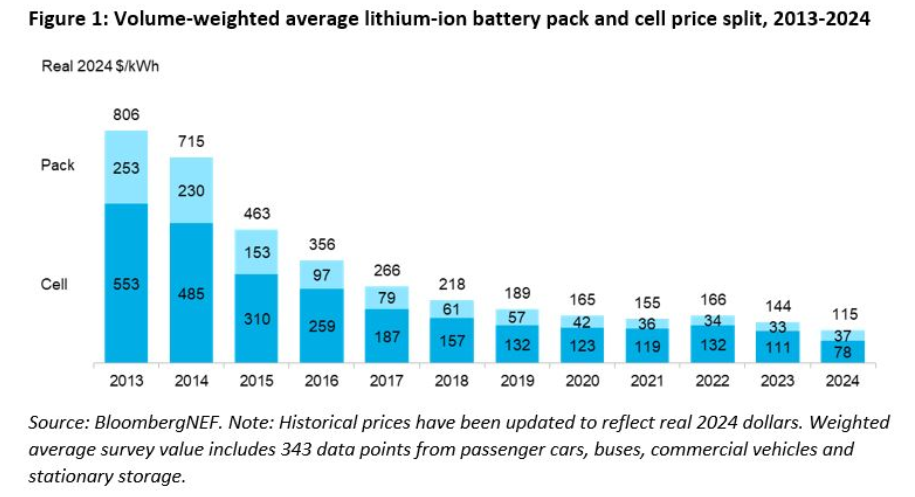

Declines in the cost of lithium-ion battery packs have been pronounced across 2024, plunging by 20% to land at US$115 per kWh. In the electric vehicle (EV) sphere, we're seeing prices dive beneath the US$100 mark, asserted BloombergNEF.

Since 2017's fall, 2024 has delivered the steepest annual decline in lithium-ion battery pack pricing, as disclosed by BloombergNEF's recent Lithium-Ion Battery Price Survey. This record-breaking drop follows a preceding 14% drop in 2023.

Breaking Down the Cost: Battery Cell vs. Pack Pricing Trends

This estimation combines the cost of the cell and the pack, priced at US$78 and US$37 respectively. The company predicts a further dip by US$3 in 2025, as seen on the historical price trend chart included below.

Key Factors Behind the Price Drop

Economies of scale, industry oversupply, lowered metal and component pricing, a slowdown in the EV market, and heightened adoption of more affordable lithium iron phosphate (LFP) batteries spearheaded this downward trend. Moreover, LFP batteries cost significantly less than their Nickel Manganese Cobalt (NMC) counterparts—making them increasingly dominant in both EVs and commercial battery storage applications.

Battery Prices for EVs and BESS: What’s Changing?

These figures encompass numerous applications. Specifically, in the realm of battery electric vehicles (BEVs), prices fell to below the US$97 per kWh benchmark, finally cutting the US$100 threshold. Following this development, EVs are now priced on par with internal combustion engine (ICE) vehicles in China, with other regions expected to follow suit.

A similar trajectory was observed in battery energy storage systems (BESS) and C&I energy storage applications, experiencing a decline of 19% to US$125 per kWh. This can be credited to Low lithium prices, fierce competition in China, increasing LFP battery adoption, and a strategic move towards larger cell and system sizes.

BloombergNEF pointed out that battery production capacity surplus is indicated by the fact that the current 3.1TWh capacity is more than double this year's demand.

Regionally, China leads with the lowest average battery pack prices at $94/kWh. In comparison, the US and Europe's battery pack prices were 31% and 48% higher respectively, a gap that has only widened over the last couple of years due greatly to China's highly competitive market. A similar pattern has been identified in the BESS sector.

"The price decline in battery cells this year outpaced that of battery metal costs, hinting at squeezed profit margins for battery manufacturers. Smaller manufacturers particularly feel the pressure to reduce cell prices in the ongoing tussle for market share," commented Evelina Stoikou, the head of BNEF’s battery technology team and lead author of the report.

Although BloombergNEF's statistics stretch over the entire year, the latter part of 2024 might reveal an even more pronounced decrease in prices.

For businesses and homeowners considering battery energy storage, now is the ideal time to invest before demand picks up again.

Why Partner with ACE Battery for Lithium Battery Solutions?

ACE Battery offers:

🔹 OEM/ODM Lithium Battery Packs & Cells customized for RVs, e-Bike, marine, floor machine, medical carts and industrial applications

🔹 Advanced Energy Storage Solutions (Residential, C&I, and on-Grid&off-Grid BESS)

🔹 LFP Battery Technology for superior safety, lifespan, and cost-efficiency

🔹 Customizable Battery Solutions tailored to industry needs for buyers, businesses, and OEMs

Contact ACE Battery today to get the best pricing on high-performance lithium battery packs, cells, and energy storage solutions!

Our expert will reach you out if you have any questions!