Inquiry

WoodMac Forecasts Steady Global Photovoltaic Growth Until 2032

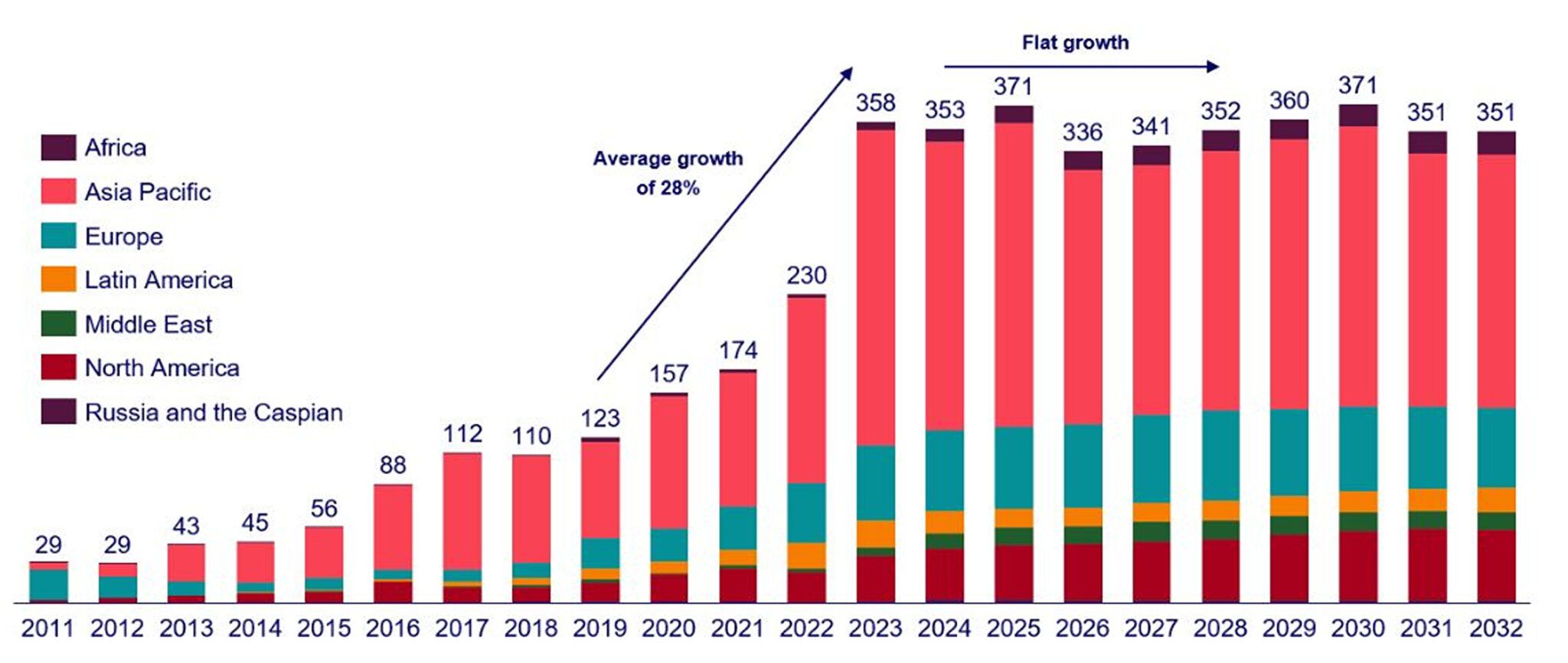

Wood Mackenzie's latest report, shared with pv magazine, reveals a significant shift in the solar industry. By 2024, it's expected to transition from rapid expansion to a more stable, mature phase. The report forecasts global solar installations averaging around 350 gigawatts annually from 2024 to 2032, peaking at 371 GW in 2025 and 2030.

The analysis indicates that the solar market, while still substantially larger than a few years ago, will experience a slowdown in growth. This marks a natural progression for maturing industries. The report emphasizes the need for solar companies to adapt, highlighting increased competition and the necessity for efficiency enhancements to stay profitable.

Key markets are driving this change. China, the largest solar market, may see a slight reduction in 2024. Factors like lagging grid infrastructure investments, changing utility-scale solar revenue schemes, and a slowdown in distributed solar growth contribute to this trend.

Europe's solar installation growth, which surged by 38% in 2022 and 26% in 2023, is projected to average 4% annually over the next five years. The expected decline is attributed to reduced energy crisis effects, a decrease in distributed solar expansion, and grid infrastructure capacity limitations.

In the United States, solar growth, at 27% from 2019 to 2023, is anticipated to decrease to 6% between 2024 and 2028. However, the full impact of the Inflation Reduction Act is expected to materialize in 2024, potentially boosting utility-scale solar projects, aiding the distributed solar segment, and tripling the domestic module manufacturing sector to 40 GW by year-end.

A significant challenge ahead is a "reckoning" for solar manufacturing in 2024. Market growth, primarily driven by China's massive module manufacturing capacity, has led to a global oversupply. This has resulted in record-low prices for Chinese modules, posing a challenge to countries' domestic solar supply chain plans. Many new facilities may not materialize, and existing ones could struggle due to declining utilization rates.

The report concludes that solar manufacturing, always a tough business, faces unprecedented challenges given the slowing global demand. Innovation and adaptability will be key for manufacturers to remain viable in this evolving landscape.

Our expert will reach you out if you have any questions!