Inquiry

Solar Industry Secures Highest Funding in a Decade in 2023

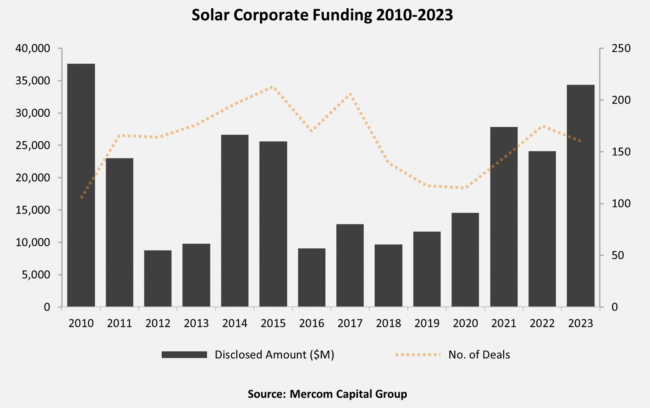

Last year, solar companies achieved a record-breaking $34.3 billion in corporate funding, the highest in ten years, as per the recent report by Mercom Capital Group. This sum garnered from 160 deals, marks a significant 42% increase from 2022's $24.1 billion raised through 175 deals.

Private market financing contributed a notable $7.4 billion, up 45% from the previous year and the second-highest since 2013. Debt financing was even more impressive, reaching $20 billion, a 67% jump from the previous year, setting a decade-high record. Mercom Capital Group highlighted that securitization deals, which amounted to $3.4 billion across 11 transactions, played a crucial role in this growth.

Despite these increases, solar venture capital funding slightly dipped by 1%, totaling $6.9 billion over 69 deals in 2023. Solar downstream companies received the lion's share of $4.7 billion (68%) for 42 deals. Other sectors like the balance of system companies and service providers raised $311 million and $32 million, respectively.

Raj Prabhu, CEO of Mercom Capital Group, commented on the trend, noting that investments in solar are consistently surpassing expectations.

According to Raj Prabhu, CEO of Mercom Capital Group, the significant investment in solar is fueled by various factors. The Inflation Reduction Act, a growing global emphasis on energy security, and supportive policies worldwide are major contributors to this trend.

Despite the robust funding environment, the solar sector's mergers and acquisitions (M&A) experienced a 25% decline in 2023, with 96 corporate deals compared to 128 the previous year. The most notable transaction involved Brookfield Renewable's acquisition of Duke Energy’s utility-scale commercial renewables business in the U.S. for roughly $2.8 billion.

Prabhu pointed out that higher borrowing costs are impacting M&A transactions, leading to more cautious investment behavior and a wait for better valuations. Solar projects remain of interest, but challenges such as high valuations, reduced risk appetite, and unpredictable project timelines due to interconnection delays, labor shortages, and component scarcity have all contributed to the decrease in project M&A activity.

In terms of large-scale solar project acquisitions, there were 231 in 2023, a drop from 268 in 2022. The total solar project capacity acquired in 2023 was about 45.4 GW, a 31% decrease from the 66 GW acquired in 2022.

Our expert will reach you out if you have any questions!