Inquiry

Predicting Europe's Renewable Energy Trajectory in Early 2024

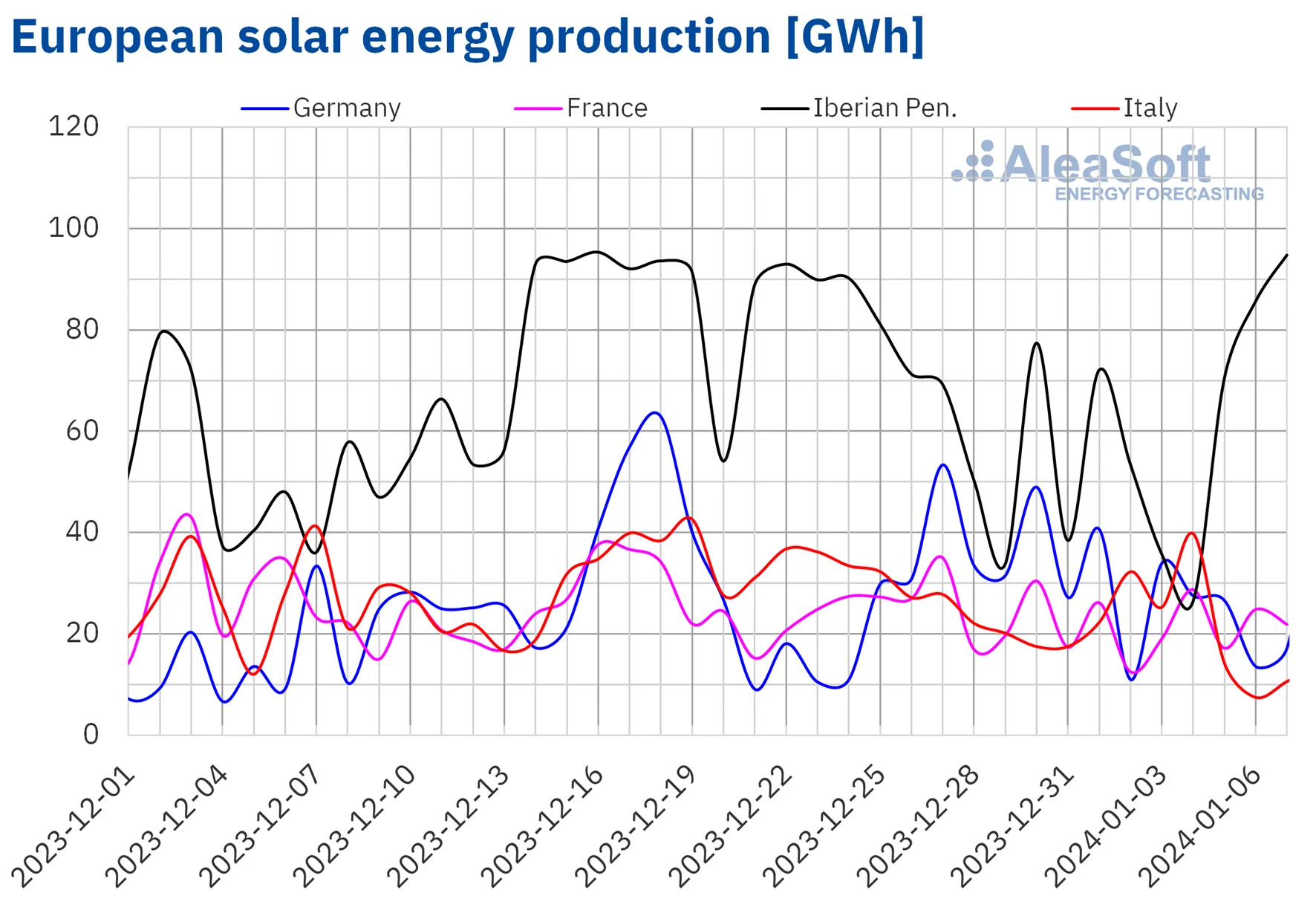

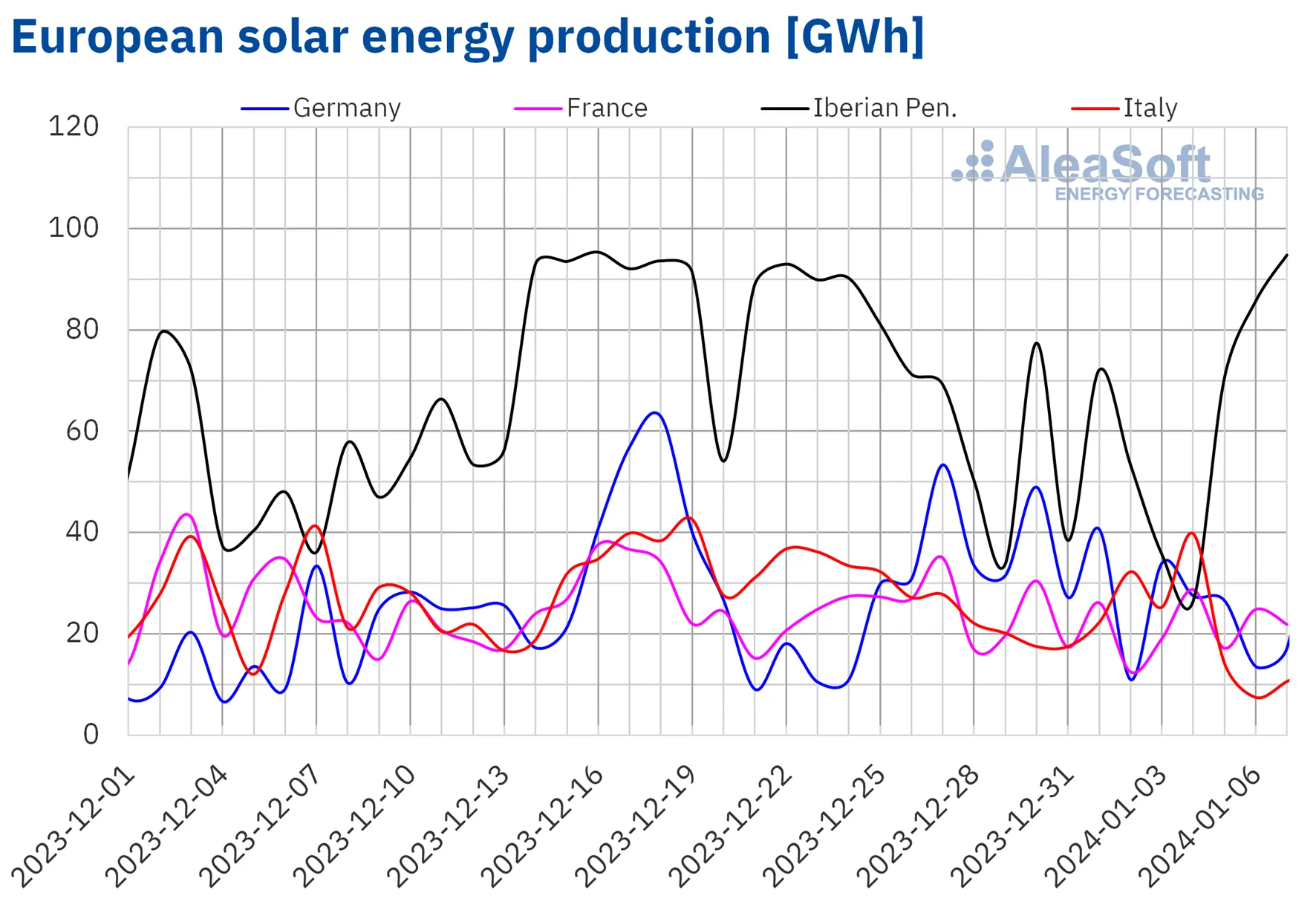

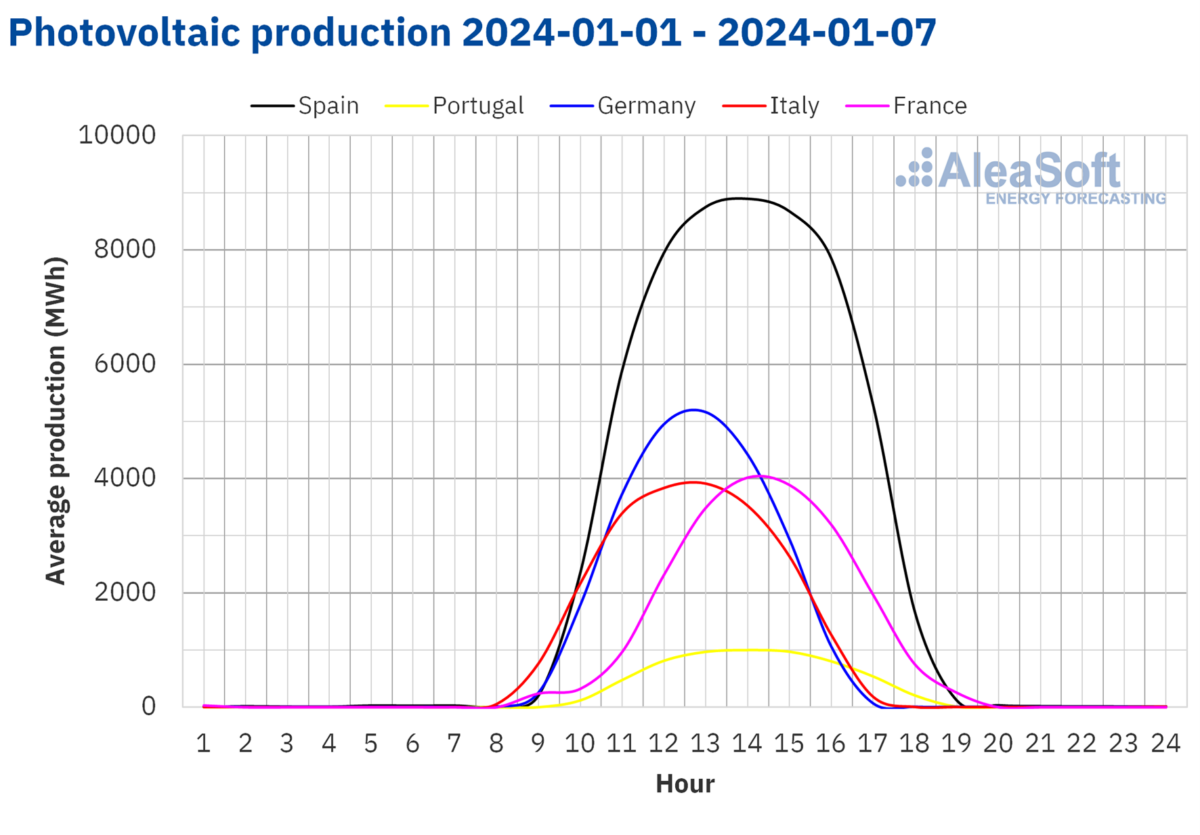

During the week starting January 1, solar energy production saw a decline in most of Europe's major electricity markets compared to the previous week. Germany experienced the most significant decrease, with a 33% drop in solar energy production. Italy had the least decline, at just 7.7%. However, the Iberian Peninsula bucked this trend, showing a 4.0% increase in solar energy production, largely due to a notable 22% rise in Portugal. Notably, on January 7, Spain reached a peak in solar energy generation, producing 80 GWh, the highest since the end of November of the previous year.

AleaSoft Energy Forecasting predicts an uptick in solar energy production for Germany, Italy, and Spain in the week following January 8.

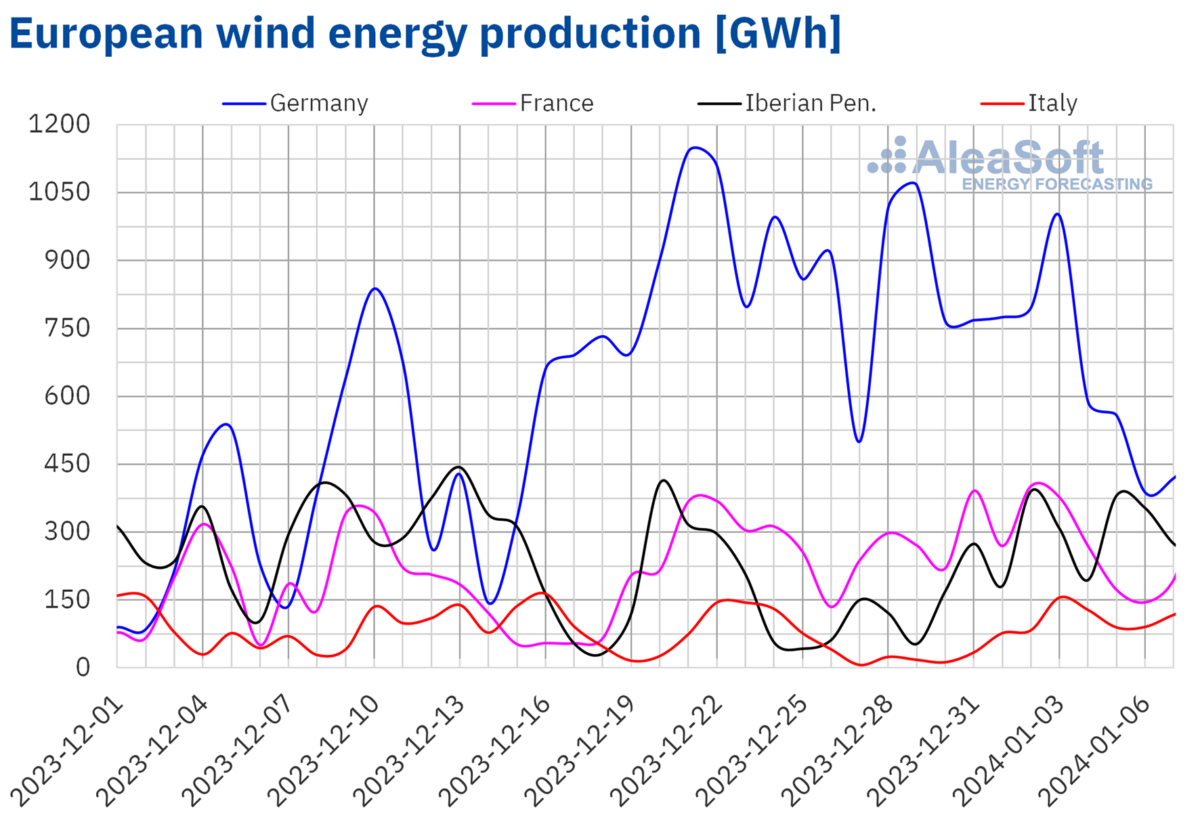

In the first week of 2024, wind energy production saw an upswing in most major European electricity markets compared to the preceding week. Italy led this increase with a remarkable 246% growth in wind energy production. Spain also saw a substantial rise of 157%. The French market experienced the smallest growth, at only 1.1%. Despite this modest increase, France achieved a significant milestone on January 2 by generating 402 GWh from wind energy, marking the highest daily output in its history. However, despite being the leading market in wind energy production for that week, Germany experienced a 23% decline from the last week of 2023.

AleaSoft Energy Forecasting's projections indicate a decrease in wind energy production across all analyzed markets for the week starting January 8.

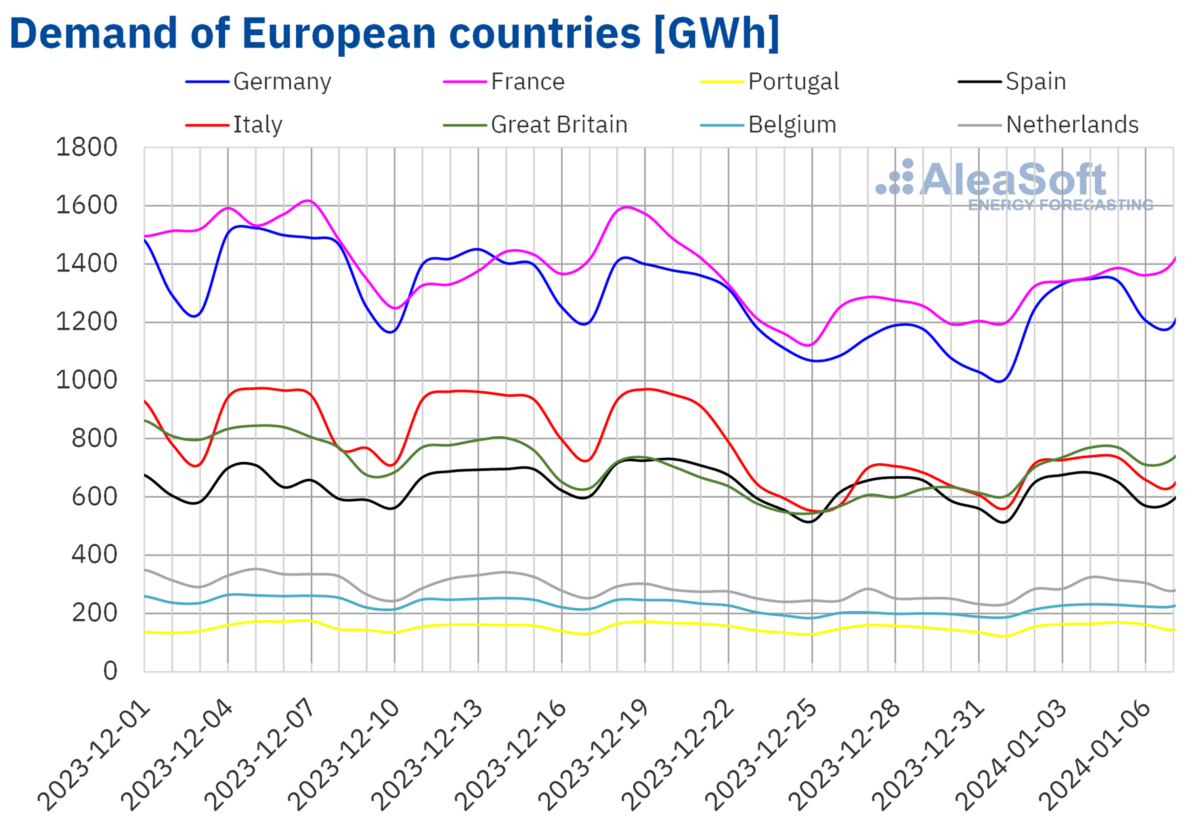

During the week of January 1, there was an uptick in electricity demand across major European electricity markets, a rebound typically expected post-Christmas celebrations. The British market saw the most significant increase, with a 20% surge in electricity demand, while the Spanish market experienced the smallest rise at 1.8%.

This first week of 2024 also witnessed a drop in average temperatures in most of the analyzed markets, contributing to the increased demand for electricity. Temperature decreases varied, with France experiencing a drop of 1.3°C and Germany seeing a more substantial decrease of 2.6°C. Conversely, Southern European countries like Italy and Spain recorded milder temperature changes, with increases of 0.3°C and 2.2°C, respectively.

AleaSoft Energy Forecasting predicts that this trend of rising electricity demand will persist, anticipating an increase across all analyzed markets in the week of January 8.

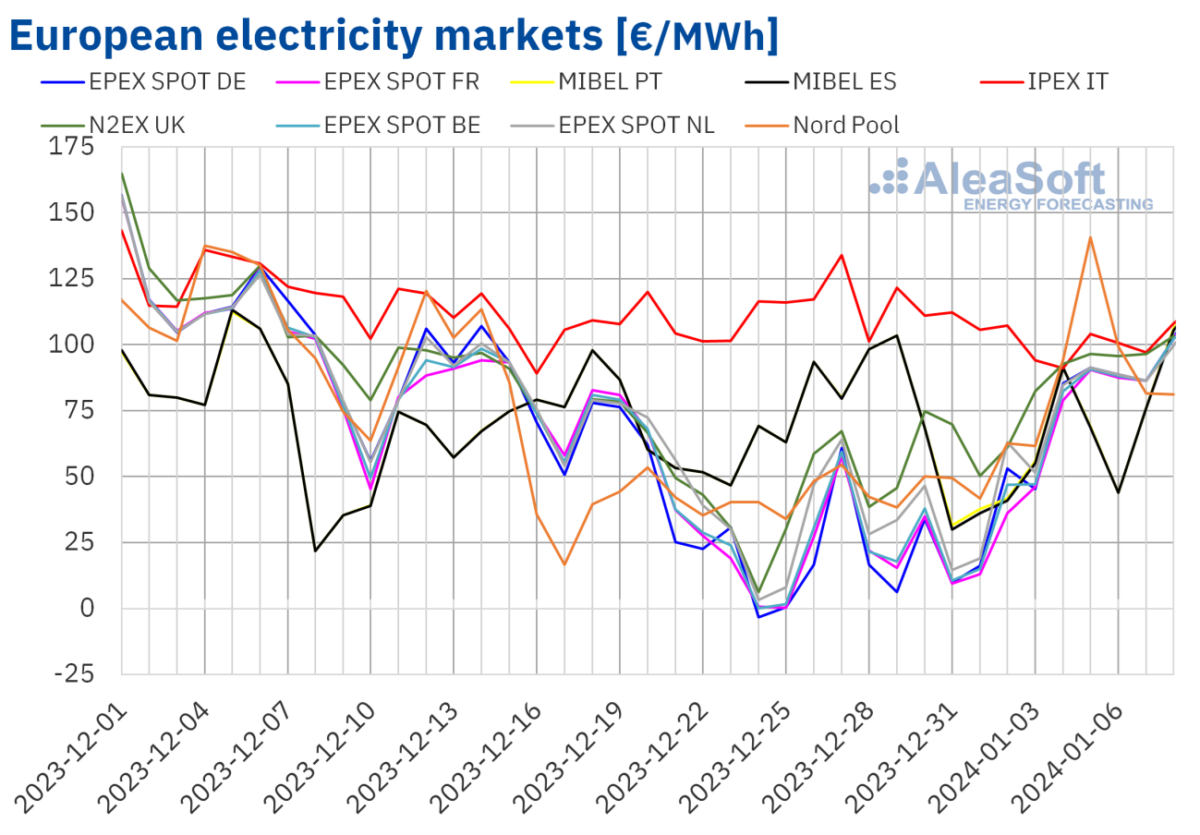

In the first week of January, most major European electricity markets saw a rise in prices compared to the previous week. However, there were exceptions: Italy's IPEX market experienced a 14% decrease, and the MIBEL market, covering Spain and Portugal, noted a significant 23% drop. On the other end of the spectrum, Germany's EPEX SPOT market recorded the highest percentage increase in prices, soaring by 222%. Other markets also witnessed price hikes, with the N2EX market in the United Kingdom increasing by 49% and the EPEX SPOT market in France going up by 163%, according to analyses by AleaSoft Energy Forecasting.

In the initial week of January, the weekly average electricity prices were under €85/MWh in almost all major European markets. Italy was the exception, recording the highest average at €100.01/MWh. Prices in other markets varied, from as low as €58.88/MWh in Spain to €83.13/MWh in the Nord Pool market of the Nordic countries.

During this period, several markets, including Germany, Belgium, France, and the Netherlands, experienced negative hourly prices on January 1 and 3. The British market also saw negative prices on January 1, though these were not as low as in the previous week. In contrast, on January 5, the Nordic market recorded a peak hourly price of €254.58/MWh between 16:00 and 17:00, the highest since December 2022. Meanwhile, the MIBEL market, covering Spain and Portugal, consistently had the lowest daily prices from January 5 to 7, contributing to its position as the market with the lowest weekly average.

The overall increase in electricity demand during this week led to higher market prices across Europe. Contributing factors included the decrease in solar energy production in countries like Germany and France and the drop in German wind energy production. However, a significant increase in wind energy production in Italy and the Iberian Peninsula helped to keep prices lower in these regions.

AleaSoft Energy Forecasting suggests that prices might continue to climb in the second week of January. This potential rise could be driven by a resurgence in demand and a general decrease in wind energy production across European markets.

On January 2, Brent oil futures for the Front-Month in the ICE market recorded their weekly lowest settlement price at $75.89 per barrel. Throughout the rest of the week, the prices generally remained above $77.50 per barrel. The highest weekly settlement price was noted on January 5, reaching $78.76 per barrel.

The first week of January saw Brent oil futures prices influenced by instability in the Middle East, along with production issues in Libya, both contributing to an upward price trend. However, Saudi Arabia's announcement of price cuts could potentially drive prices down in the second week of January.

TTF gas futures in the ICE market for the Front-Month also showed fluctuations. On January 2, they continued their downward trend from the last sessions of the previous week, hitting the week's lowest settlement price at €30.57/MWh – the lowest since mid-August 2023. Prices began to climb from January 3, culminating in a weekly high of €34.55/MWh on January 5, marking a 6.8% increase from the previous Friday.

The anticipated cold snap in Europe initially drove TTF gas futures prices up in the first week of January. However, the start of the second week saw a potential shift due to milder temperature forecasts, abundant supply, and high European gas stock levels, which might lead to a decrease in future prices.

In the realm of CO2 emission rights, the EEX market's December 2024 reference contract saw a decrease in settlement prices during the first week of January compared to the previous week. The weekly high was €77.35 per ton on January 3, but prices dropped by 2.0% in the following session, reaching a weekly low of €75.82 per ton.

For more relevant information, subscribe to ACE Battery.

Our expert will reach you out if you have any questions!